Your chapter’s statement is now live and accessible 24/7 through mySigEp. This statement of accounts will outline any outstanding payments that are owed to the national fraternity – including new member registration fees, fall and spring bills, and any late or no-show fees assessed to the chapter’s account. To view your chapter’s statement:

1. Select your chapter from the group selector in the top right corner beside your name.

2. Click on “Chapter Statement”

3. View individual invoices to see charges; select the charge (or multiple charges) that you wish to pay for using the checkbox.

4. Select “Make Payment” to be taken to the payment screen

Please ensure the correct details are entered upon submitting payment. A 1% fee will be assessed on all returned/bounced payments. If you have any questions, please reach out to the Headquarters staff about your bill.

NOTE: AVC members have view-only access to the chapter’s statement of accounts. Chapter officers are currently the only ones who can submit payment directly from the statement of accounts. If an AVC member wishes to pay on behalf of the chapter, he/she may do so by mailing a physical check 310 South Arthur Ashe Boulevard, Richmond, VA 23220.

What payment methods are accepted?

1. In mySigEp, you can pay via credit/debit card. We use Authorize.net as our secure payment processor and it accepts Visa, Mastercard, American Express and Discover.

2. Alternatively, you can mail a physical check addressed to Sigma Phi Epsilon Fraternity at 310 S. Arthur Ashe Blvd., Richmond, VA 23220 with the chapter’s name and invoice description in the memo line.

3. If you wish to pay via bank transfer (commonly referred to as e-Check), email billing@sigep.net.

Many banks offer a “bill pay” option where you can request a check to be sent directly from your bank account or set up recurring payments to pay off past due balances.

Why was my payment declined?

There are multiple reasons why the payment would be declined. The national fraternity does not decline payments directly for any specific reason. The payment was likely declined by your bank due to one of three reasons:

1. The credit card or bank information was entered incorrectly

2. The billing address or point of contact was entered incorrectly

3. The bank has a transaction limit on your credit/debit card and/or has flagged the payment as potentially fraudulent. The national fraternity cannot help you bypass this. You must call your bank and ask for a one-time transaction limit increase to make a payment and clear the payment to the Sigma Phi Epsilon Fraternity as an approved payment.

Please do not wait until the last minute to make a payment towards your bills. Overdue invoices may be subject to late fees, regardless of whether the payment was attempted or declined. It is your responsibility to pay on time, which includes making sure that your bank will allow the transaction to occur. Some chapters opt to pay the maximum daily limit until the balance is paid.

If you are unable to increase your transaction limit or send a physical check, email billing@sigep.net for alternative payment methods.

How do I write a check?

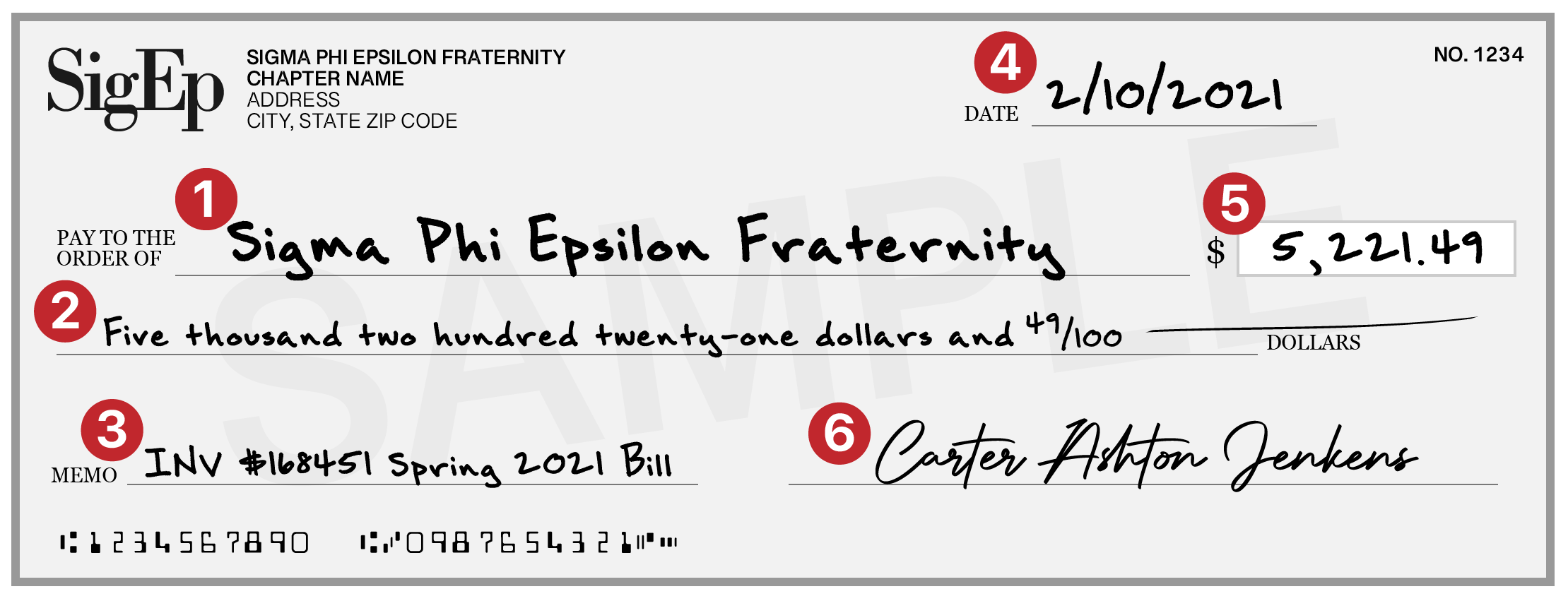

If this is your first time writing a check, use the picture above and the instructions below to ensure that the check is written correctly and able to be deposited towards your chapter’s balance. While the look and feel of your check may be slightly different, be sure all parts of the check are filled out completely and your handwriting is legible to prevent delay or potential late fees.

1. Recipient: This is the name of the entity you are sending the check to. Generally, if you’re paying bills to the Grand Chapter, the recipient will be “Sigma Phi Epsilon Fraternity”.

2. Amount in Words: Write the amount in word form on the second line underneath the “Pay to the Order of” line. Write out the whole dollar amounts in word form followed by “and XX/100” for the cents. To avoid fraud and prevent anyone from manipulating the intended amount of the check, at the end of your cents, draw a line across the rest of the check. You can use online generators to convert numbers to word format.

3. Memo/Purpose: This is where you indicate what you’re paying for. This line is optional, but it helps the recipient quickly understand what the purpose of the payment is for. When possible, reference a specific invoice number or purpose in this line to help expedite the deposit.

4. Date: In the upper right-hand corner, write the current date on that line. Post-dating a check, or writing a date that is later than today’s actual date, is not recommended.

5. Numeric Amount: Write the amount in numbers in the box to the right of the dollar sign, separating dollars and cents by a decimal point. For a check over thousand dollars you may use commas as thousands separators.

6. Signature: Finally, ensure the check is signed on the bottom right by an authorized individual – this may require you to visit the bank with a previous officer to ensure you’re an authorized signer on the account. Checks are invalid without a signature that matches the signature on file at the back.