Editor’s Note: The Sigma Phi Epsilon Citation is bestowed upon alumni who have achieved extraordinary success and stature in their chosen professions. Since the award was first presented in 1965, only 256 have received the honor. Among them are world leaders, titans of industry and commerce, renowned authors and artists, civil servants and military heroes, award-winning actors and all-star athletes.

Here, we share the story of one of the five brothers honored with this award at the 56th Grand Chapter Conclave in Houston.

Mike Watford, Florida ’75, grew up in a military family. Relocating frequently meant he’d never really had a chance to put down roots and establish long-lasting friendships. So, when he arrived at the University of Florida, he was ready to find a group of friends he could laugh with, grow with and depend on. That’s exactly what he found in SigEp.

In addition to being involved in the Fraternity, he served as treasurer of the Interfraternity Council for a year and worked two part-time jobs the majority of his time in college. Watford made the most of those years, learning how to prioritize his responsibilities so that he could have time to work, participate in Greek life, attend the Saturday afternoon football games that he’d come to love and still perform well in the classroom.

After earning his bachelor’s degree in finance, Watford moved to New Orleans to start his career with Shell Oil. He also began taking classes at night to earn his MBA while continuing to work at Shell. By the time he left the company, he’d completed his master’s and gained a wealth of professional experience. In a career spanning more than 40 years, Watford held management positions in natural gas, exploration and production, finance, and marketing at a number of energy companies, including Superior Oil, Meridian Oil (formerly Burlington Resources) and Torch Energy.

He drew on this wide range of experience when he was appointed CEO of Nuevo Energy in 1994. In just a few years, he took the company from a valuation of $200 million to over $1 billion. Then in 1999, Watford was tapped to helm natural gas company Ultra Petroleum, which he led until his retirement.

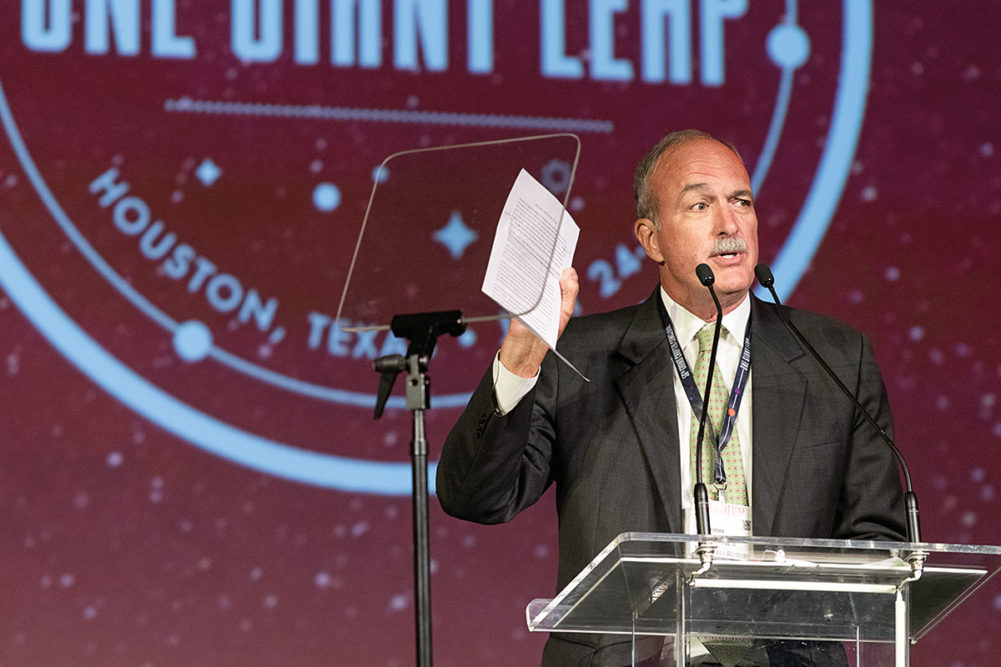

At the Citation award presentation, he jovially remarked that as the final recipient, he had been instructed to keep his remarks brief and limit his speech to one side of a piece of paper. Watford did keep his comments short, but he packed plenty of substance into the few minutes he spent onstage.

He shared that although his career began at a large oil company, he’d found the greatest opportunities at smaller companies. Consolidation in the industry left Watford without a job — more than once. But he bounced back. The key, he explained, was that he rethought what career success looked like for him. “What I discovered was to be less fearful of the downside — the risk of future job loss — and more captivated by the upside: the reward. I went from big oil to medium to small oil … I went from big bureaucracies where there was no upside to taking risks to more nimble, entrepreneurial organizations where effective risk-taking was rewarded.”

Watford said he never would have considered this strategy if he hadn’t lost his job. But when he did, he turned the lemons he was given into lemonade. The result: He spent more than two decades as the CEO of two companies, and even ended up on the Forbes list of highest paid CEOs in 2011.

Leave a Reply